Passed in November 2020, California Proposition 19 offers significant property tax relief for homeowners aged 55 and older. This proposition allows seniors to sell their home and buy a new one anywhere in California without a dramatic increase in property taxes. This is especially beneficial for those on a fixed income who are looking to downsize but worry about higher property tax assessments.

Prop 19 offers several benefits. Seniors can transfer the assessed value of their existing home to a new home, even if the new home is more expensive. The property tax assessment is based on the original home’s assessed value, plus any difference in market value between the old and new properties. This can lead to significant tax savings. Unlike previous laws, Prop 19 allows these tax benefits for moves anywhere in California, providing more options for seniors to find the perfect new home. Seniors can use this benefit up to three times, offering flexibility as their housing needs change over time.

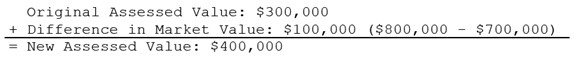

Here’s an example. Imagine selling a home with an assessed value of $300,000 for a market price of $700,000. Then, you buy a home for $800,000. With Prop 19, the assessed value of the new home would be calculated as follows:

Without Prop 19, the new home’s assessed value would be $800,000, leading to much higher property taxes.

By understanding and using this proposition, seniors can downsize or relocate to a more suitable home while keeping their property taxes in check. If you have any questions about Proposition 19 or anything else real estate related, please reach out. I’m here to help you.