Our mission is helping people move with confidence to the best home for their best life. This requires clearly defining your best life. Whether or not you should buy a home right now depends most on what’s happening in your life right now and the kind of future you desire. Current home prices, the trend of prices, and other market factors will influence what options are available at the moment, but they won’t tell you which option is best for your life. Here are some questions to consider:

- How confident am I that my skills and abilities will continue allowing me to earn a steady income for the next several years?

- How am I doing in managing money? How consistently do I meet my financial commitments and put money into savings?

- How comfortable am I paying a landlord’s mortgage rather than my own? Whose financial future do I want to invest in?

- How comfortable am I knowing that my landlord might force me to move at a time I didn’t choose?

- Am I better off paying rent that will likely rise or with a fixed mortgage payment on a home I own?

If you answered favorably to the first two questions and feel concerned when you think about the last three questions, it’s probably worth exploring buying your own home. The best place to start is to connect with a home-loan adviser who can educate you about what programs would open up the best opportunities for you. If you’d like to get connected with a home-loan adviser that we know and trust, call or text Caleb at 626-328-4199.

Some of you are thinking, “Prices are so high, and I don’t want to buy something that will lose value in the future.” Your concern is completely reasonable, and we’d like to offer you some perspective on how it could still be a good decision to buy even when prices seem high.

A drop in home prices doesn’t cause you to lose money.

Buying at a high price and selling at a low price causes you to lose money. Generally, people only sell at a loss if they can’t do at least one of the following:

- Sell for a price that will recoup their money.

- Earn enough money to cover the monthly payment and living expenses until prices rise again.

- Rent the home for enough money to cover the monthly payment until prices rise again.

- Get the lender to modify the terms of the loan to allow keeping the home until prices rise again.

- Get help from family or friends to keep the home until prices rise again.

Generally, even when prices drop, you are still gaining financial ground in the long run.

In most markets, real estate appreciates over the long term unless a dramatic economic calamity strikes the region. Prices will rise and fall every 7 to 10 years or so, and each peak in the cycle will generally be higher than the last. This means that even if you buy at the peak of a cycle, you’ll still gain ground as long as you hold onto the home until the next peak. If you use a home loan to purchase your home, you’ll be paying down the balance. It’s like having automatic, monthly deposits into an equity piggy bank. Below is a simple example of renting versus owning.

10 Years owning versus 10 years renting

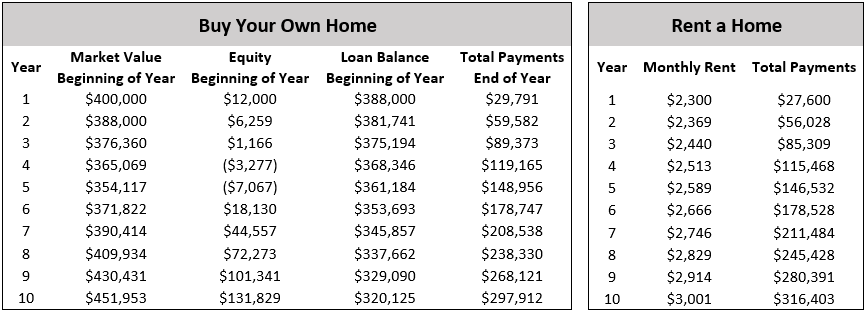

Assume you buy a home for $400,000 with 3% down and a 97% loan at 4.5% interest fixed for 30 years. Your total monthly payment with property taxes and insurance will be about $2,482 per month. Assume also that the value drops some (3% annually) in the first five years and then recovers (5% annually) in the following five years according to a typical real estate cycle. Separately, assume you rent a home starting at $2,300 a month with rent increases of 3% per year to keep up with inflation. Here’s what’s happens over 10 years:

At the end of 10 years, the renter paid more total housing cost than the owner did, and the renter has no equity while the owner has $131,829 in equity. We understand that this is just one facet of owning versus renting, and there are lots of others to consider. Sometimes renting really is best for now.

If you’d like to have an honest conversation about what’s possible and what might be best for you, call or text Caleb at 626.328.4199.