11/15/2023

If you’ve been struggling to save enough down payment to make buying a home affordable, or if you’ve been struggling to save a down payment altogether, the California Housing Finance Agency (CalHFA) is renewing a new program that may help you. The Dream for All Shared Appreciation Loan offers a no-payments, no-interest assistance loan for up to 20% of the purchase price on a home. When you repay the loan later, you pay back the original assistance loan, plus 20% of the increase in the value of the home since you bought it.

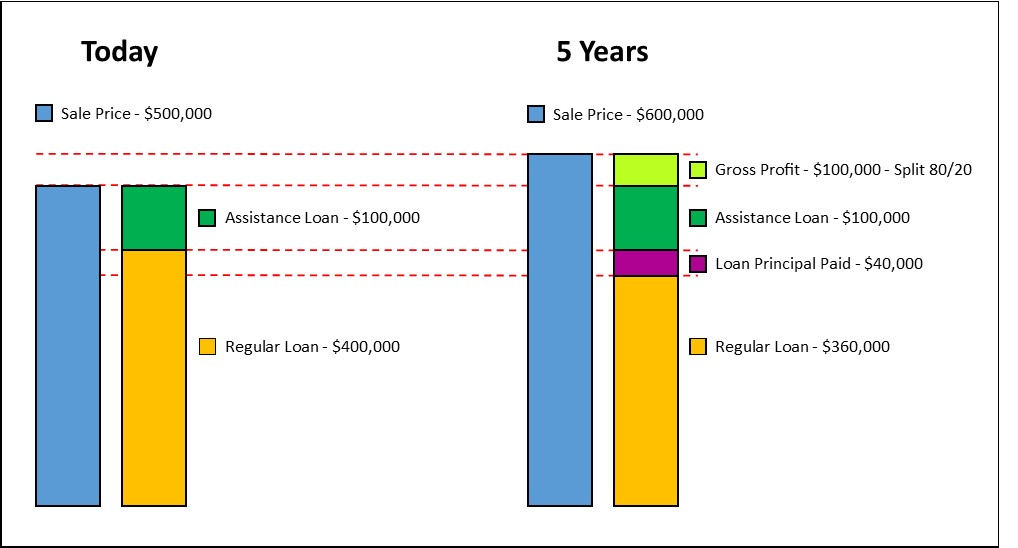

Here’s an example of how it would work if you used the program to buy a home for $500,000. You’d get a CalHFA, conventional loan for $400,000, which is 80% of $500,000. The CalHFA shared appreciation loan provides the other $100,000, which is 20% of $500,000. Let’s assume that in five years, you choose to sell, and you’re able to get $600,000. The home appreciated by $100,000, and CalHFA gets 20% of that appreciation, which means they would get $20,000. The original assistance loan is still $100,000 (no interest and no payments), so CalHFA gets a total of $120,000.

You’d make strong financial progress in this scenario too. Let’s assume you paid down the loan balance by $40,000 over the five years. CalHFA doesn’t get any of that, and you get 80% of the appreciation. In our example, that would be $120,000 in equity growth.

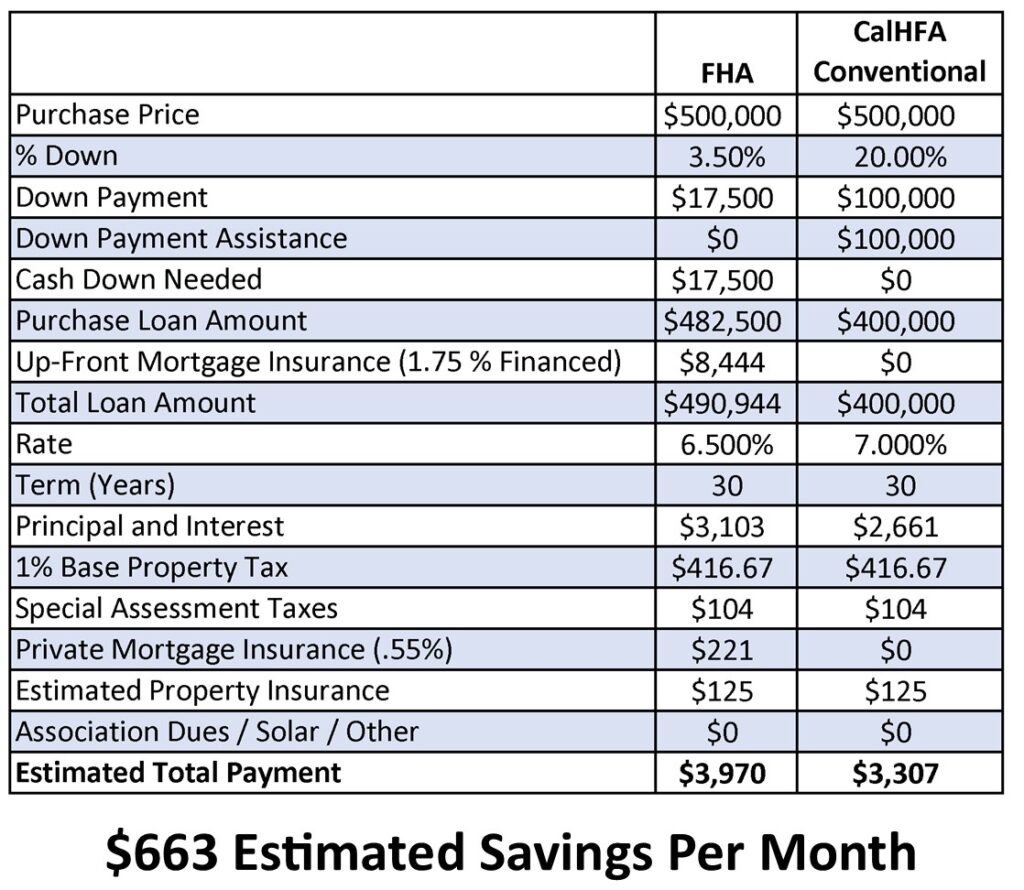

On top of the equity growth you can gain with no down payment using this program, you can also save a lot monthly compared to other low-cash financing options. Federal Housing Administration (FHA) loans only require 3.5% down, and historically, they’ve been the most common kind of loan to combine with a down-payment assistance program. That’s awesome for those struggling with saving a down payment, but the mortgage insurance costs and the larger loan amount make the payment a lot. The chart below illustrates how, for the same $500,000 home, you’d save an estimated $663 per month using the CalHFA conventional loan combined with the Dream for All Shared Appreciation Loan compared to a typical FHA loan with 3.5% down.

Here are some basic requirements for qualifying to use this program:

- You must be a first-time homebuyer, which means you haven’t owned a primary residence in the last three years. If you owned a home in another state, rented it out to move here, and have been renting the house you live in here for the last three years, you might still qualify.

- You must have a 680 or higher FICO score.

- You must be able to qualify for the CalHFA conventional loan.

- You must complete CalFHA’s homebuyer education class requirements. Details at (https://www.calhfa.ca.gov/dream/)

- Your household income must be below the CalHFA limits for the county where the home is located:

- Los Angeles: $180,000 per year

- San Bernardino: $173,000 per year

- Riverside: $173,000 per year

- Orange: $235,000 per year

- Complete CalHFA Income Limits by County

CalHFA says they are going to determine how much funding they are going to allocate for this in January 2024 and start applications in April 2024. Earlier this year, the $300,000,000 allocated to the California Dream for All program ran out in a week. If you think you want to take a run at using this program, it’s really important that we get you ready ahead of time. We want to be ready to go house hunting in the couple of weeks before they start taking applications so you’ll be in a good position to make an offer using the program while the money is available.

If you are interested please let us know right away. We’ll connect you with a lender who can help you look at the details of your situation and confirm if this program is a good fit for you.

Call or text Caleb at 626-328-4199 now to get started or use the form below!

Contact Us

Sorry we are experiencing system issues. Please try again.